- Some taxpayers must file and some should file

- The requirements are based on income and filing status

- Taxpayer who must file have no choice; they have a legal requirement to file

- Some taxpayers should file – There is no legal requirement to file but it may be beneficial to the taxpayer

- See IRS Pub 4012, Section A for details.

Examples of Who MUST File

- Taxpayer with Single filing status under age 65 with gross income ≥ $15,750

- Married taxpayers under age 65 filing joint return with gross income ≥ $31,2500

- Any taxpayer who had subsidized Marketplace health insurance during tax year

- Self-employed taxpayer with income ≥ $400

- Married Filing Separately income > $5

- The rest of the rules are listed in Pub 4012, Section A pages 1-3

Examples of Who SHOULD File

- Taxpayers who had withholding in excess of their tax liability

- If taxpayer is due a refund they must file a tax return in order to receive the refund

- Taxpayers who had federal income tax withheld on Social Security income

- Taxpayers who might qualify for credits

- As we will see later in this course, some taxpayer may get money back even if they haven’t paid anything in

- Again, the only way to get this credit is to file a tax return

- All taxpayers – reduce identity theft

Determining the correct filing status is one of the most important aspects of return preparation. Unfortunately, it is often difficult because people have heard so much misinformation from friends and family. It is your job as a preparer to determine the correct filing status. Even if the situation appears straightforward, you must ask questions to verify the information. Many of our clients qualify for thousands of dollars in credits, but they only apply to certain filing statuses. It’s important to ensure that the return is prepared correctly so that taxpayer receives the full amount of the refund to which he or she is entitled. Do not rely on information from prior years. The situation may have changed or the previous return may have been done incorrectly.

Do not rely solely on the software, or your gut or logic – tax laws are not always logic!

Do not rely on the taxpayer to tell you the filing status. Most people do not fully understand what the different filing statuses mean.

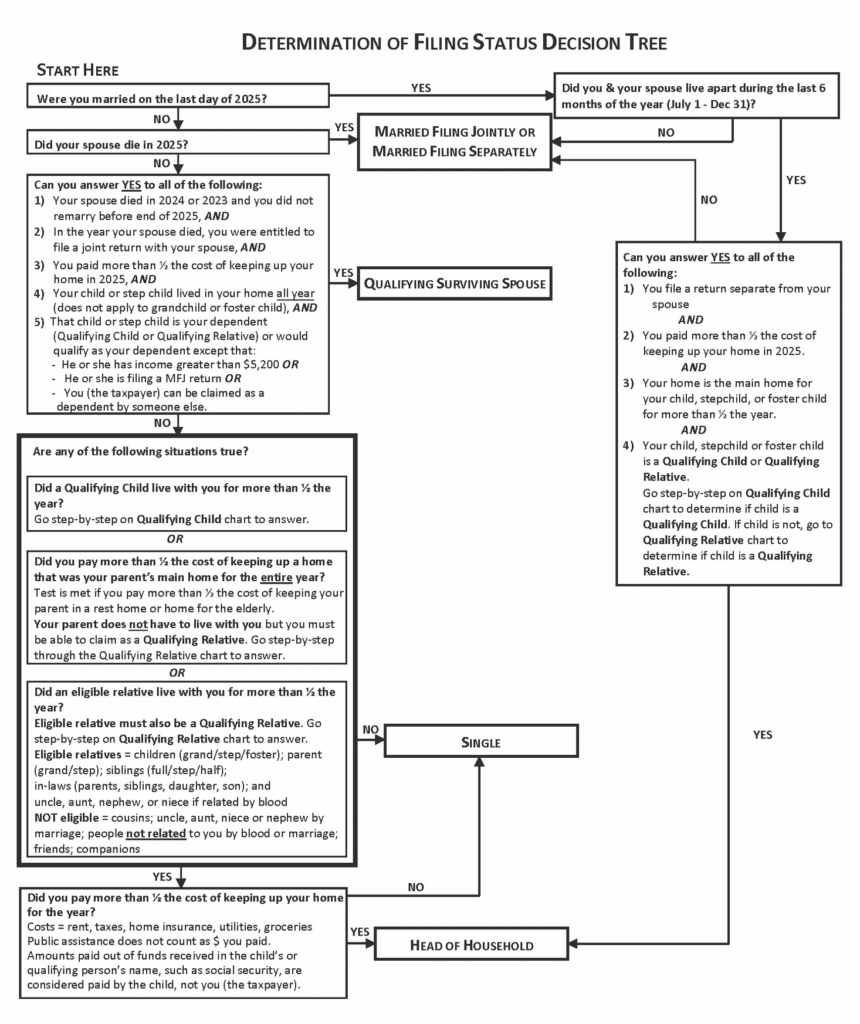

Do not guess or rely on your memory. Always use the filing status decision tree shown further down in this lesson. It can also be found in the Volunteer Handbook.

In the following we will describe each filing status and who should use them

Single

Taxpayers may use Single filing status if on the last day of the tax year they were:

- Unmarried

- Legally separated (does not apply in Texas)

- Divorced, or

- Widowed before the beginning of the tax year, did not remarry before Dec 31, and have no qualifying children

Taxpayers may file as Single only if they were unmarried as of the last day of the year. This is true if the taxpayer has never been married, is divorced, or was widowed before January 1 of the tax year. This can be an issue because taxpayers may consider themselves as single when they are still legally married. Married taxpayers cannot file as single even if not currently living with their spouse. The term “Legally separated” is not recognized in Texas. Also, there is no such thing as “Married filing Single” or “Common Law Divorce”.

Married Taxpayers

Married taxpayers have 2 options:

- Married Filing Jointly

- Married Filing Separately

Marriage includes

- Same sex marriage

- Common law marriage (e.g., Texas)

- A legal marriage that occurs without a ceremony or other formalities is known as an informal or common law marriage. The couple must meet the following requirements in Texas:

- Neither of them must have been married, formally or informally, at the time the marriage was created

- They must live in Texas as a married couple after the marriage is created, and

- They must represent themselves to others as a married couple

- Both people must be over age 18 and agree to be married

- There is no “common law divorce”

- A marriage will generally be recognized for federal tax purposes if it is recognized by the state, possession, or territory of the United States in which the individuals married, regardless of the state of the couple’s domicile.

- Determined by marital status on last day of tax year

- Always ask about marital status on 12/31

- Do not use what was on last year’s return if client brings it in – it may be different this year

- Married is married! – If you are legally married but are separated, for 10 days or 10 years, and you do not get a legal divorce you are still married and must file MFS unless HOH applies to you. These terms will be discussed later. Mentioning HOH here is just a start toward explaining that HOH is the one exception for not filing MFJ or MFS if you are considered married.

- Legal separation issued in another state doesn’t apply to Texas residents

- There are a lot of misconceptions regarding tax law, people listen to friends and neighbors who may be wrong or have different situation.

- Common law marriage

- The IRS recognizes common-law marriages if legal in state of domicile

- Texas is common-law state

- Living together in a common law state is usually insufficient – you need to hold yourself out as married including owning property together, having joint bank accounts, etc. If you meet your states’ rules you are legally married

- The IRS sets no required time frame for living together

- A legal marriage that occurs without a ceremony or other formalities is known as an informal or common law marriage. The couple must meet the following requirements in Texas:

Married Filing Jointly (MFJ)

- For MFJ, as of the last day of the tax year taxpayers must be

- Legally married; or

- Widowed during the year and did not remarry

- Holding themselves out as married, otherwise known as common law marriage

- Both spouses must agree to file MFJ

- Do not marry taxpayers by preparing MFJ return

- You are married in the United States regardless of where you get married. Example: you get married in Russia, one spouse stays there and the other spouse comes to the US. The spouse in the US, if working, must file MFS unless HOH (to be discussed later) applies.

- May file MFJ even if only one spouse has income

- Always ask whose name should go on the return first

- If the return does not carry the information over from a previous year do not take the first person’s name on the intake sheet as the primary tax payer without asking.

- If they say they don’t care you need to tell them that it needs to be the same from one year to the next.

- Income or work status does not dictate who is the main taxpayer

- You cannot claim your spouse as a dependent

When using Married Filing Jointly filing status, the couple uses one return to report their combined income and allowed deductions. To file as Married Filing Jointly, a couple must be married, and both spouses must agree to file a joint return. This is important because they are both responsible for the full amount of tax, interest, and penalties on a joint return. This can be an issue if the couple separates or divorces later, and there are unpaid taxes from a joint return. The IRS can try to collect the full amount from either spouse even if taxes were caused by only one of them. A couple living together as married, but are not legally married, can file as Married Filing Jointly. Make sure both spouses agree to this filing status; you as a tax preparer should not assume or imply this status.

Married Filing Separately (MFS)

- The married filing separately status is for taxpayers who are married under the definition provided above, and either:

- Choose to file separate returns or

- Cannot agree to file a joint return

- Married taxpayers who choose not to file as MFJ must file as MFS.

- Again: THERE IS NO SUCH THING AS MARRIED FILING SINGLE

- Politely ask why they are filing separately. If they say, “I don’t know”, then you might want to discuss the benefits of MFJ over MFS, such as:

- Larger standard deduction

- Lower tax rate

- Available credits/adjustment– can’t get EITC, child and dependent care credit, education credit, or student loan interest adjustment

- If filing MFS because one spouse owes back taxes, child support, or student loans, suggest filing as INJURED SPOUSE

- This will allow them to get up to half of their refund but they receive less than half.

- THE INJURED SPOUSE FORM (Form 8379) SHOULD BE FILLED OUT BY A MANAGER OR AN EXPERIENCED VOLUNTEER.

- There can be a good reason to file as MFS. Both taxpayer and spouse are legally liable for full amount of tax liability even if due to other spouse’s income. If taxpayer doubts spouse’s honesty, they may be better off filing as MFS.

- Don’t push people to file MFJ but make sure they understand consequences and other options available

- This can sometimes be a emotional subject, and If you do not feel comfortable asking these questions talk to your MANAGER or an experienced tax preparer.

- MFS filing is tricky in a community property state like Texas

- TaxSlayer Pro: if taxpayer does not know spouse SSN, use 111-00-1111 & file paper return. You cannot use e-File without both spouses’ SSN

Special Rules Regarding Marriage

Some state courts issue Legal Separation Orders. Texas is not one of them, so only divorced people are treated as unmarried at BakerRipley Tax Centers. Persons who are “legally separated” are treated as married.

Texas does recognize Common Law Marriage. Persons who are considered married for state law purposes under Texas’ common law rules are treated as married for tax purposes. However, there is no “common law divorce”, so they have to file for a legal divorce to file as Single again.

Some client may claim they have always filed as Single, or even Head of Household, while still being married. We cannot unhear what we have heard, so do not let the client pressure you to use a filing status that is not correct. As will be discussed below, some married clients may qualify to file Head of Household, but they have to meet certain criteria. Please talk to a manager if you are uncomfortable or unsure!

MFJ vs MFS

If filing MFS, the taxpayer will not qualify for credits such as the American Opportunity Credit or Dependent Care Credit or the student loan interest deduction. In addition, a larger portion of Social Security income could be taxable. Finally, the MFJ tax rate may be more beneficial than the one used for MFS. The main advantage of filing MFS is that the taxpayer is not responsible for the spouse’s tax liability.

NOTE: There are a few issues that can cause confusion. A couple can file as MFJ even if only one spouse has income. Under no circumstances should the taxpayer claim the spouse as a dependent. Either name can be listed first, but it should be the same from year to year. Always ask; do not assume that the first name listed on the intake sheet is the one that should go first.

Head of Household (HOH)

We can spend a lot of time on this subject. This is the most complex filing status, and as a volunteer you must be aware that every situation is different and if you have any doubt as to whether or not someone qualifies as HOH, you need to look it up and follow the steps in the Filing Status Decision tree, or call a manager. The Filing Status Decision tree is included below, and also printed in the Volunteer Handbook.

General Rule

- A taxpayer may file as HOH if he or she meets ALL of the following requirements

- Taxpayer is not married (single, divorced, or legally separated), on the last day of the tax year

- Taxpayer paid more than half the cost of keeping up a home for the year

- A Qualifying Person lived with you in that home for more than half the year, except for temporary absences (a dependent parent is not required to live with you).

Exception for married taxpayers

- Married taxpayer may qualify to file as HOH if considered unmarried by the IRS. ALL of the following must be true.

- There are cases where a person is still legally married but lives separately from their spouse, who provides little or no support. Even if you are still legally married, you MAY be considered unmarried for the purposes of the Head of Household filing status if all of the following statements are true:

- Taxpayer’s spouse did not live with taxpayer anytime during last six months of tax year (temporary absences don’t count as not living with you).

- Taxpayer is filing return separately from spouse

- Taxpayer paid more than half of the costs of keeping up home during the year

- Qualifying Child who is the taxpayer’s child, stepchild, or foster child lived in the home for over half the year (except temporary absences).

- Taxpayers may also choose the Head of Household status if they are not married and maintain a home for their parent(s).

- This home must be the principal place of abode for the parent(s), but it does not have to be the same home as that of the taxpayer.

- The parent(s) must qualify as the taxpayer’s dependent(s).

Filing Head of Household will in many cases give the taxpayer more deductions, but it is important to verify that they qualify for this filing status. Please use the Filing Status Decision Tree in the Volunteer Handbook or the IRS publication 4012 (also see below), to make sure they meet all the requirements listed above.

Qualifying Surviving Spouse

All of the following must be true for the taxpayer to file as a Qualifying Surviving Spouse

- Taxpayer’s spouse died within the two years prior to the tax year

- For example, if the spouse died in 2023, the taxpayer may filed as Qualifying Surviving Spouse for Tax Year 2025 if they meet the following criteria:

- Taxpayer was entitled to file a joint return with the spouse the year the spouse died, regardless of whether they actually filed a joint return or not

- Taxpayer did not remarry before the end of the tax year

- Taxpayer provided over half the cost of keeping up a home for themselves and a qualifying relative

- Have a child, stepchild, or adopted child who qualifies as the taxpayer’s qualifying child or qualifying relative for the year. There is no age limit for the “dependent child”.

Qualifying Surviving Spouse is only available as a filing status if the taxpayer has a Qualifying Child or Qualifying Relative, and the spouse died within the two pervious years. Many taxpayers are not aware of this filing status, so please make sure to check carefully on the intake form if they have checked this box. If the spouse died in the current tax year, the taxpayer can file MFJ as long as they would have qualified for this filing status if the spouse was still alive.

- The taxpayer’s child or step child must have lived in the taxpayer’s home for all of the tax year except for temporary absences. The taxpayer must be able to claim the child as a dependent or would have been able to claim the child as a dependent except that the child’s gross income exceeds $5,200, the child is filing an MFJ return, or the taxpayer can be claimed as a dependent by someone else.

- The main instance when one of these exceptions will occur is if the child’s gross income is greater than $5,200. For example, if the child is a 21-year old part-time student making $5,300, the taxpayer cannot claim the child as a dependent. However, if the taxpayer is providing over half the child’s support and the child meets all the other dependency requirements, the taxpayer can file as a Qualifying Surviving Spouse.

Filing as a Qualifying Surviving Spouse allows the taxpayer to use the same standard deduction as if filing a Married Filing Jointly Return.

Filing Statues Flow Chart / Decision Tree

There are many rules regarding filing status. To help ensure they are applied correctly, we have created a flow chart that takes all these rules into account. You can see it here, but it can also be found in the Volunteer Handbook (online or in the hard copy). You start in the upper left hand corner answering the question about the taxpayer’s marital status on December 31 of the current tax year. It also asks questions about dependents that would qualify a taxpayer for a particular filing status and whether or not the taxpayer pays over half the cost of a home. Please make it a practice to use this flowchart when determining taxpayers’ filing status. Do not guess or try to rely on memory, or even use logic. Tax laws are not always logic.

There are Filing Status Exercises later in this course. Each of the ten scenarios have video walkthroughs explaining the answers!

You must log in and have started this course to submit a review.